UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

VALVOLINE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 6. | Amount Previously Paid:

| |||

| 7. | Form, Schedule or Registration Statement No.:

| |||

| 8. | Filing Party:

| |||

| 9. | Date Filed:

| |||

100 Valvoline Way

Lexington, KY 40509

December 15, 201716, 2019

Dear Valvoline Inc. Shareholder:

On behalf of our Board of Directors and management, we cordially invite you to attend the 20182020 Annual Meeting of Shareholders of Valvoline Inc. The meeting will be held on Wednesday,Thursday, January 31, 2018,30, 2020, at 11:8:00 a.m. (ET), at Valvoline’s principal office, 100 Valvoline Way, Lexington, KY 40509.

We are pleased to provide access to our proxy materials via the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to most of our shareholders a Notice of Internet Availability of Proxy Materials (“Notice”) instead of a paper copy of this Proxy Statement, a proxy card and our 20172019 Annual Report. The Notice contains instructions on how to access those documents over the Internet, as well as instructions on how to request a paper copy of our proxy materials. All shareholders who do not receive a Notice, including shareholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy of the proxy materials by mail. We believe that this approach provides a convenient way for you to access our proxy materials and vote your shares, while reducing the costs of printing and distributing our proxy materials and conserving natural resources.

The attached Notice of Annual Meeting and Proxy Statement describe the business to be conducted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. We encourage you to promptly vote and submit your proxy via the Internet or by telephone using the instructions on the Notice, or, if you received paper copies of the proxy materials, you may also vote by following the instructions on the proxy card and signing and returning it in thepre-addressed postage-paid envelope provided for your convenience. If you attend the Annual Meeting, you can vote in person even if you previously submitted your proxy.

We appreciate your continued confidence in Valvoline and look forward to seeing you at the meeting.

Sincerely,

|

| |||

Samuel J. Mitchell, Jr. Chief Executive Officer | Stephen F. Kirk Chairman of the Board |

Notice of Annual Meeting of Shareholders

|

Date

Wednesday,Thursday, January 31, 201830, 2020

Time

11:8:00 a.m. (ET)

Place

Valvoline Inc.

100 Valvoline Way

Lexington, KY 40509

Record Date

December 4, 20172, 2019

| Agenda | ||

| ➊ | Election of | |

| ➋ | Ratification of the appointment of our independent registered public accounting firm; | |

| ➌ | Non-binding advisory resolution approving our executive compensation; and | |

| ➍ | ||

| Consideration and transaction of any other business properly brought before the meeting. | ||

| You can vote one of the following ways |

Internet

|

Visit the website listed on your proxy card to vote VIA THE INTERNET |

Telephone

|

Call the telephone number specified on your proxy card to vote BY TELEPHONE |

|

Sign, date and return your proxy card in the enclosed envelope to vote BY MAIL |

In Person

|

Attend the Annual Meeting to vote IN PERSON |

To Our Shareholders:

Your vote is very important. Please submit your vote as soon as possible. Follow voting instructions in your proxy materials when voting via the internet, by telephone or by mail. Submitting your proxy by one of these methods ensures your representation at the Annual Meeting regardless of whether you attend.

Only shareholders of record at the close of business on December 4, 2017,2, 2019, are entitled to notice of, and to vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors,

Julie M. O’Daniel

Senior Vice President, General CounselChief Legal Officer

and Corporate Secretary

Lexington, Kentucky

December 15, 201716, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JANUARY This Proxy Statement and our http://investors.valvoline.com/financial-reports/proxy.

|

|

|

|

| Compensation Discussion and Analysis

| ||||

| Page

| ||||

| 22 | |||

| 23 | ||||

| 23 | Compensation Philosophy | |||

| 24 | Pay for Performance | |||

| 27 | What We Do vs. What We Don’t Do | |||

| 27 | Elements of Valvoline’s Executive Compensation Program | |||

| 28 | Role of Consultant | |||

| 29 | Peer Group | |||

| 30 | Benchmarking / Survey Data | |||

| 30 | Internal Pay Equity | |||

| 30 | “Say on Pay” | |||

| 30 | Base Salary | |||

| 31 | Annual Incentive | |||

| 33 | Long-term Incentive | |||

| 35 | Health and Welfare Benefits | |||

| 36 | Executive Perquisites | |||

| 36 | Retirement Benefits | |||

| 36 | Severance Benefits | |||

| 37 | ||||

| 39 | Clawback Policy | |||

| 39 | Stock Ownership Guidelines | |||

| 39 | Anti-Hedging / Anti-Pledging Policy | |||

| 40 | Risk Assessment | |||

|

Questions and Answers About the Annual Meeting

|

| ∎ | Why did I receive these proxy materials? |

You are invited to attend the 20182020 Annual Meeting of Shareholders (the “Annual Meeting”) of Valvoline Inc. (“Valvoline,” the “Company,” “we,” “us,” and “our”) and vote on the proposals described in this Proxy Statement because you were a shareholder of record of Valvoline common stock, par value $0.01 per share (“Valvoline Common Stock”), as of the close of business on December 4, 20172, 2019 (the “Record Date”), the record date for determination of shareholders entitled to notice of and to vote at the Annual Meeting. Valvoline is soliciting proxies for use at the Annual Meeting, including any postponements or adjournments.

The Annual Meeting is being held at 11:8:00 a.m. (ET) on January 31, 2018,30, 2020, at Valvoline’s principal office, 100 Valvoline Way, Lexington, KY 40509.

| ∎ | What is included in these proxy materials? |

If you received printed versions by mail, these printed proxy materials also include the proxy card or voting instruction form for the Annual Meeting.

| ∎ | Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of printed proxy materials? |

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish proxy materials, including this Notice of Annual Meeting of Shareholders and Proxy Statement, together with our 20172019 Annual Report, by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they have specifically requested them. Instead, a Notice of Internet Availability of Proxy Materials (“Notice”) will be mailed to shareholders starting on or around December 15, 2017.16, 2019.

| ∎ | How do I access the proxy materials? |

The Notice will provide you with instructions regarding how to view Valvoline’s proxy materials for the Annual Meeting, including this Proxy Statement and the 20172019

Annual Report, on the Internet. The Notice also instructs you on how you may submit your vote. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

| ∎ | Who can attend the Annual Meeting? |

Each shareholder of record of Valvoline as of the Record Date is invited to attend the Annual Meeting, although seating is limited. If your shares are held in the name of a broker, bank or other nominee, you will need to bring valid photo identification, such as a driver’s license or passport, and an account statement, proxy or letter from that nominee that confirms you are the beneficial owner of those shares as of the Record Date.

| ∎ | Who may vote at the Annual Meeting? |

Only shareholders of record of Valvoline as of the Record Date are entitled to receive the Notice of Annual Meeting of Shareholders and to vote their shares at the Annual Meeting. As of the Record Date, there were 201,836,337188,441,162 shares of Valvoline Common Stock issued and outstanding and entitled to vote. Each share of Valvoline Common Stock entitles the shareholder to one vote on each matter properly brought before the Annual Meeting.

| ∎ | What am I voting on? |

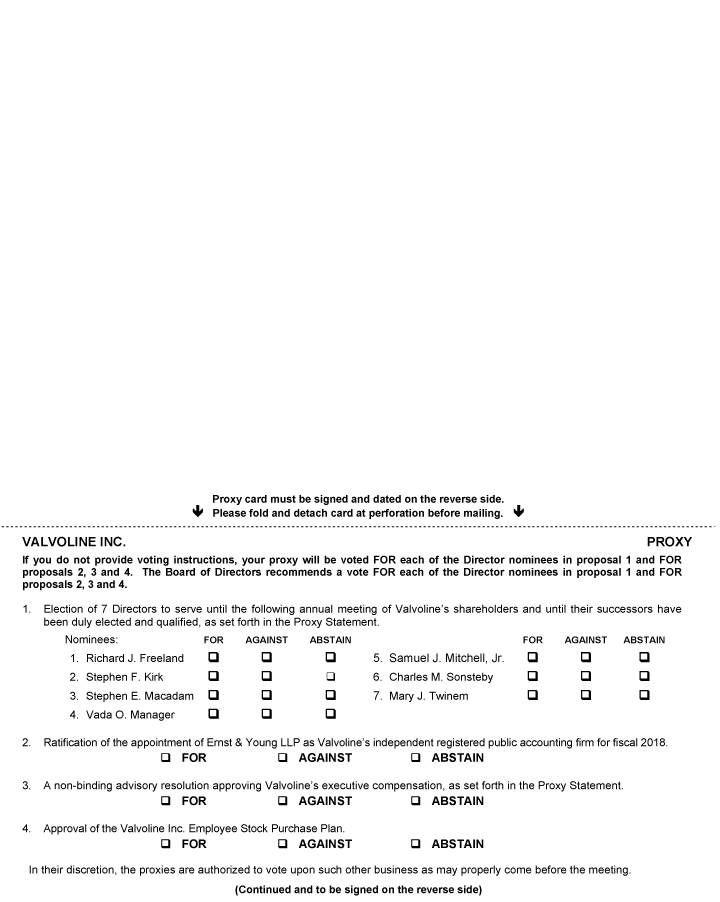

At our Annual Meeting, shareholders will consider and vote on the following matters:

|

| ∎ | How can I vote? |

If you are a registered shareholder as of the Record Date, you can vote (i) by attending the Annual Meeting, (ii) by following the instructions on the proxy card for voting by telephone or Internet or (iii) by signing, dating and mailing in your proxy card. If you hold shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the meeting, you must first obtain a proxy issued in your name from the institution that holds your shares.

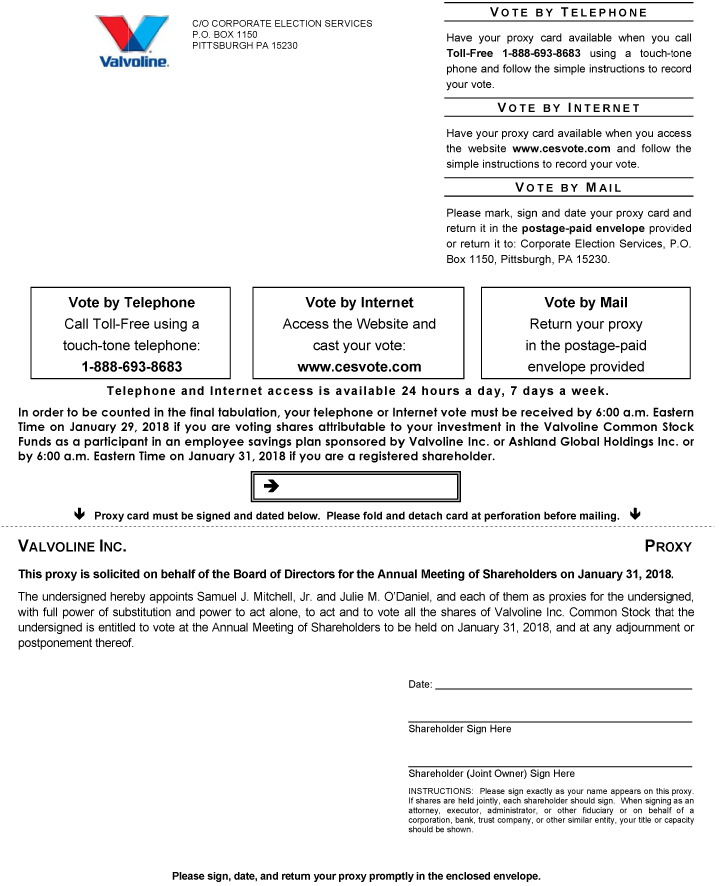

All shares represented by validly executed proxies will be voted at the Annual Meeting, and such shares will be voted in accordance with the instructions provided. If no voting specification is made on your returned proxy card, Samuel J. Mitchell, Jr. or Julie M. O’ Daniel,O’Daniel, as individuals named on the proxy card, will cast the votes represented by such proxy card (i) FOR the election of each of the sevennine director nominees, (ii) FOR the ratification of EY as our independent registered public accounting firm for the 20182020 fiscal year, and (iii) FOR thenon-binding advisory resolution approving our executive compensation, and (iv) FOR the approval of the Valvoline Inc. Employee Stock Purchase Plan.compensation.

| ∎ | How do I vote shares attributable to the units of Valvoline Common Stock Fund credited to my account in the Valvoline |

If you are a participant in the Valvoline Inc. 401(k) Plan, Ashland Savings Plan, Ashland ISP 401(k) Plan, or the Ashland Union Plan and are invested in the Valvoline Common Stock Fund within such plansplan as of the Record Date, you are entitled to instruct the trustee, of such plans, Fidelity Management Trust Company, on how to vote any shares attributable to the units of Valvoline Common Stock credited to your account. The trustee will vote such shares as you instruct.To allow sufficient time for the trustee to vote, your voting instructions must be received by no later than 6:00 a.m. (ET) on January 29, 2018. 28, 2020. If you do not provide instructions by that time, the shares attributable to the units of Valvoline Common Stock credited to your account will be voted by the trustee in accordance with the rules of each plan.same proportion as it votes all the shares for which it has received timely voting instructions.

| ∎ | What shares are included on the proxy card? |

Your proxy card represents all shares of Valvoline Common Stock that are registered in your name. If your shares are held through a broker, bank or other nominee, you will receive either a voting instruction form or a proxy card from your broker, bank or other nominee instructing you on how to vote your shares.

| ∎ | Can I change my vote once I vote by mail, by telephone or over the Internet? |

Yes. You have the right to change or revoke your proxy (1) at any time before the Annual Meeting by (a) notifying our Corporate Secretary in writing, (b) returning a later-dated proxy card or (c) entering a later dated telephone or Internet vote; or (2) by attending the Annual Meeting and voting in person, which will automatically cancel any proxy previously given, or by revoking your proxy in person, but attendance alone will not revoke any proxy that you have previously given.

If your shares are held through a broker, bank or other nominee, you must contact your broker, bank or other nominee to change your vote.

| ∎ | Who will count the vote? |

A representative of Corporate Election ServicesBroadridge Financial Solutions, Inc. will serve as the inspector of election for the Annual Meeting. The inspector of election will determine whether a quorum is present and will tabulate the votes cast by proxy and in person.

| ∎ | Is my vote confidential? |

Yes. Your vote is confidential.

| ∎ | What constitutes a quorum? |

As of the Record Date, 201,836,337188,441,162 shares of Valvoline Common Stock were outstanding and entitled to vote at the Annual Meeting. A majority of the shares issued and outstanding and entitled to be voted at the Annual Meeting must be present in person or by proxy to constitute a quorum to transact business at the Annual Meeting. If you vote in person, by telephone, over the Internet or by returning a properly executed proxy card, you will be considered a part of that quorum. Abstentions and brokernon-votes (i.e., when a broker does not have authority to vote on a specific issue) will be treated as present for the purpose of determining whether a quorum exists.

| 2 |   |

| ∎ | What vote is required for approval of each matter to be considered at the Annual Meeting? |

| • | Election of directors—Pursuant to Article V of our Amended and Restated Articles of Incorporation (“Articles”), a director nominee will be deemed elected if the number of votes cast “for” that director nominee exceeds the number of votes cast “against” that director nominee. |

| • | Ratification of independent registered public accounting firm—The appointment of EY will be deemed ratified if the number of votes cast “for” its ratification exceeds the number of votes cast “against” it. |

| • | Non-binding advisory resolution approving our executive compensation—Thenon-binding advisory resolution approving our executive compensation will be deemed passed if the number of votes cast “for” the resolution |

| ∎ | What is a BrokerNon-Vote? |

If your shares are held by a broker, you must instruct the broker on how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal for which the broker does not have discretionary authority to vote. This is referred to as a “brokernon-vote.” Brokernon-votes are counted as present in determining whether a quorum exists at the Annual Meeting, but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange (“NYSE”).

Under the NYSE rules, your broker has discretionary authority to vote your shares on the ratification of Valvoline’s independent registered public accounting firm, even if your broker does not receive voting

instructions from you. However, your broker does not have discretionary authority to vote on the election of Directors or the advisory vote on executive

compensation, or the approval of the Employee Stock Purchase Plan, without instructions from you. If you do not instruct your broker on these discretionary matters, a brokernon-vote will occur and your shares will not be voted on these matters.

| ∎ | Who will pay for the cost of this Proxy Solicitation? |

The Company is making this proxy solicitation and will bear the cost of soliciting proxies. In addition to these proxy materials, the solicitation of proxies may be made in person, by telephone or by other electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We have also retained Georgeson LLC to assist in the solicitation for estimated fees of $10,500 plus reasonableout-of-pocket expenses. We may also reimburse brokers, banks, or other agents for the cost of forwarding proxy materials to beneficial owners.

| ∎ | Can I access the Company’s Proxy Statement and Annual Report electronically? |

Yes. This Proxy Statement and the 20172019 Annual Report are available on our investor relations website athttp://investors.valvoline.com/investors.valvoline.com/financial-reports/proxy, and at the SEC’s website,http://www.sec.gov.

| ∎ | Does the Company offer an opportunity to receive future proxy materials electronically? |

Yes. If you wish to view Valvoline’s future proxy materials and annual reports over the Internet instead of receiving copies in the mail, follow the instructions provided when you vote through the Internet. If you vote by telephone, by mail or in person, you will not have the option to elect electronic delivery while voting. If you elect electronic delivery, we will discontinue mailing our proxy materials and annual reports to you beginning next year and will instead send you ane-mail message notifying you of the Internet address or addresses where you may access such proxy materials and annual reports and vote your shares.

|

| ∎ | Where can I find the voting results of the meeting? |

We intend to announce preliminary voting results at the Annual Meeting. We will report the final results on a Current Report onForm 8-K filed with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form8-K to

disclose preliminary voting results and, within four business days after the final results are known, we will file an amended Form8-K with the SEC to disclose the final voting results. You can obtain a copy of theForm 8-K from our investor relations website athttp://investors.valvoline.com/sec-filings, by calling the SEC at1-800-SEC-0330 for the location of the nearest public reference room or through the SEC’s EDGAR system athttp://www.sec.gov.

| 4 |   |

Proposal One - Election of Directors

|

Proposal and Required Vote

Our Board of Directors (the “Board”) currently consists of the following eight members all of whom were elected at the 2017 Annual Meeting of Shareholders:nine members: Gerald W. Evans, Jr., Richard J. Freeland, Stephen F. Kirk, Carol H. Kruse, Stephen E. Macadam, Vada O. Manager, Samuel J. Mitchell, Jr., Charles M. Sonsteby and Mary J. Twinem and William A. Wulfsohn. At the endTwinem. Other than Mr. Evans, each member of Valvoline’s fiscal year on September 30, 2017, Mr. Wulfsohn retired as Chairman of our Board and notified the Board that he would not stand forre-election upon the expiration of his term as a directorwas elected at the 2019 Annual Meeting.Meeting of Shareholders. Mr. Evans was elected by the Board, effective December 1, 2019. Each of the other seven directors on the current members of our Board has been nominated for election at the Annual Meeting. The Board has resolved to reduce its size from eight to seven members effective as of the date of the Annual Meeting to eliminate the vacancy that would otherwise result from Mr. Wulfsohn’s decision not to stand forre-election. See the “Corporate Governance—Valvoline’s Board of Directors” section of this Proxy Statement for further information about the structure, operations and roles of our Board. The Governance and Nominating Committee (“G&N Committee”) of our Board has confirmed that all sevennine nominees will be available to serve as directors upon election and recommends their election.

Directors are elected at each annual meeting of shareholders and hold office until the following annual meeting of shareholders and until their successors have been duly elected and qualified. Pursuant to our Articles, a director nominee in an uncontested election must receive the affirmative vote of a majority of votes cast with respect to that director nominee in order to be elected to our Board. Therefore, to be elected at the Annual Meeting, a director nominee must receive more votes cast “for” his or her election than votes cast “against” his or her election. Abstentions and brokernon-votes will not be counted as votes cast. Nominees elected at the Annual Meeting will serve until our 20192021 Annual Meeting of Shareholders and will hold office until their successors are duly elected and qualified.

Pursuant to the Board’s resignation policy in our Corporate Governance Guidelines (published on our website athttp://investors.valvoline.com/governance), any nominee who is serving as a director at the time of an uncontested election who fails to receive a greater number of votes “for” his or her election than votes “against” his or her election will tender his or her resignation for consideration by the Board no later than two weeks following the certification of the shareholder vote. The Board will decide, through a process managed by the G&N Committee, whether to accept the resignation within 90 days following the shareholder meeting.annual meeting of shareholders. The Company will then promptly disclose the Board’s decision and reasons therefor. As a condition to his or her nomination, each person nominated by the G&N Committee must agree in advance to abide by the policy. Each of the current members of our Board, other than Mr. Wulsohn, has been nominated for election at the Annual Meeting andnominee has agreed to abide by this policy.

If no voting specification is made on a properly returned or voted proxy card, Samuel J. Mitchell, Jr. or Julie M. O’Daniel (as proxies named on the proxy card) will cast the votes represented by such proxy card FOR each of the sevennine nominees named in this Proxy Statement. Should any of the nominees be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies may vote for a replacement nominee recommended by the Board, or the Board may reduce the number of directors to be elected at the Annual Meeting.

Information Concerning Director Nominees

The sevennine individuals nominated for election as directors at the Annual Meeting are Gerald W. Evans, Jr., Richard J. Freeland, Stephen F. Kirk, Carol H. Kruse, Stephen E. Macadam, Vada O. Manager, Samuel J. Mitchell, Jr., Charles M. Sonsteby and Mary J. Twinem. Each of these nominees is currently a member of our Board and has agreed to stand for election. Background information about each director nominee is set forth below, including information regarding the specific experiences, characteristics, attributes and skills considered in connection with the nomination of each director nominee, all of which the Board believes provide the Company with the perspective and judgment needed to guide, monitor and execute its strategies.

|

Gerald W. Evans, Jr. Chief Executive Officer of Hanesbrands Inc. Director since: 2019 Age: 60 Committees: • Compensation • Governance & Nominating | Professional Experience: Mr. Evans has served as a director of Valvoline since December 2019. Mr. Evans has also served as Chief Executive Officer of Hanesbrands Inc., a leading global marketer of basic apparel, since October 2016. From 2013 to 2016, Mr. Evans served as Chief Operating Officer of Hanesbrands and asCo-Chief Operating Officer from 2011 to 2013. Prior to that, he served asCo-Operating Officer, President International of Hanesbrands from 2010 to 2011. He was President of Hanesbrands’ International Business and Global Supply Chain from 2009 to 2010 and served as President of its Global Supply Chain and Asia Business Development from 2008 to 2009. Mr. Evans served as Executive Vice President, Chief Supply Chain Officer of Hanesbrands from 2006 to 2008. Prior to that, he spent more than 20 years in various leadership positions at Sara Lee Corporation. Mr. Evans is also a member of the Business Roundtable. Education: Mr. Evans holds a Bachelor of Science in marketing and a Master of Business Administration from the University of South Carolina. Public Company Board: Mr. Evans has served as a director of Hanesbrands Inc. since 2016. |

Qualifications: As the Chief Executive Officer of Hanesbrands, Mr. Evans’ experience and knowledge in the areas of consumer products, managing international operations and global supply chains, leading omnichannel expansion, building brands, executing acquisition strategies and marketing and sales provide him with the qualifications and skills to serve as a director on our Board. He also brings significant experience gained from service on the board of directors of Hanesbrands. | ||

Richard J. Freeland Retired President and Chief Operating Officer of

Director since:2016

Age:

Committees: •Governance & Nominating •Compensation

| Professional Experience: Mr. Freeland has served as a

Education: Mr. Freeland holds a Bachelor of Science Public Company Boards: Mr. Freeland served as a director of Cummins Inc. from July 2017 to October 2019. |

Qualifications: As the former President and Chief Operating Officer of Cummins Inc., Mr. Freeland’s significant experience and knowledge in the areas of product development, manufacturing, international operations, sales and marketing, as well as his experience in the automotive and

| ||

| 6 |  | PROXY STATEMENT |

Stephen F. Kirk Chairman of

Director since:2016

Age:

Committees: •Governance & Nominating •Compensation

| Professional Experience: Mr. Kirk is Valvoline’s Chairman of the Board, effective October 2017, and has served as a

Education: Mr. Kirk holds a

Public Company Boards: Mr. Kirk served as a director of Ashland Global Holdings Inc. from November 2013 until January

Non-Profit Boards: Mr. Kirk serves as Executive in Residence at the Monte Ahuja College of Business at Cleveland State University. He is also a member of the board of trustees of Cleveland State University Board |

Qualifications: As the former Senior Vice President and Chief Operating Officer of The Lubrizol Corporation, Mr. Kirk’s experience and knowledge in the areas of international operations, sales and marketing, and corporate leadership, as well as his experience in the automotive and transportation industry, provide him with the qualifications and skills to serve as a director on our Board. He also brings significant experience gained from service on the board of directors of other publicly-traded companies.

| ||||

Carol H. Kruse Former Chief Marketing Officer of ESPN and Cambia Health Solutions Director since:2018 Age:57 Committees: • Governance & Nominating • Compensation | Professional Experience: Ms. Kruse has served as a director of Valvoline since December 2018. Ms. Kruse served as Senior Vice President and Chief Marketing Officer of Cambia Health Solutions, a health solutions company, from December 2014 to January 2019. Prior to joining Cambia Health Solutions, she was Senior Vice President and Chief Marketing Officer at ESPN, a global omni-channel sports programming and content company, from October 2010 until October 2013. Prior to that position, she served as Vice President, Global Digital Marketing, at The Coca-Cola Company from July 2007 until October 2010 and as Coca-Cola’s Vice President, North America Interactive Marketing from August 2001 to July 2007. Education: Ms. Kruse holds a Bachelor of Arts in international relations from Pomona College and a Master of Business Administration from the University of Southern California. Privately-Held Company Boards: Ms. Kruse has served as a director of Unified, Inc. and as Chair of its Compensation Committee since 2014. Non-Profit Boards: Ms. Kruse serves on the board of directors and as Portland Chapter President of The CMO Club. She is also a member of the board of trustees of Portland’s Pioneer Courthouse Square and on the Executive Committee of Go Red for Women/American Heart Association for Oregon. |

Qualifications: Ms. Kruse’s significant experience and knowledge in the areas of digital marketing, sports and entertainment marketing, technology platform design and development, and consumer acquisition, retention and engagement through digital, mobile and social channels provide her with the qualifications and skills to serve as a director on our Board. | ||||||

|

Stephen E. Macadam

Director since:2016

Age:

Committees: •Governance & Nominating •Compensation | Professional Experience: Mr. Macadam has served as a

Education: Mr. Macadam holds a Bachelor of Science

Public Company Boards: Mr. Macadam has served as a director of EnPro Industries, Inc. since 2008 and Louisiana-Pacific Corp since February 2019. Within the past five years, Mr. Macadam also served as a director of Axiall Corporation from |

Qualifications: As the former President and Chief Executive Officer of EnPro Industries, Inc., Mr. Macadam’s experience and knowledge in the areas of

| ||

Vada O. Manager President and Chief

Director since: 2016

Age:

Committees: •Audit •Governance & Nominating(Chair) •Compensation

| Professional Experience: Mr. Manager has served as a

Education: Mr. Manager holds a Bachelor of Science

Public Company Mr. Manager served as a director of Ashland Global Holdings Inc. from 2008 until January

Non-Profit Boards: Mr. Manager serves on the board of trustees of ASU and previously served as the chair of |

Qualifications: As the President and

| ||||||

| 8 |   |

Samuel J. Mitchell, Jr. Chief Executive Officer and Director of Valvoline Inc.

Director since:2016

Age:

Committees: N/A

| Professional Experience: Mr. Mitchell has served as a

Education: Mr. Mitchell holds a

Non-Profit Boards: Mr. Mitchell serves on the

|

Qualifications: Mr. Mitchell has led the Valvoline business for the past 18 years and over that time has gained extensive knowledge of the Valvoline business and the automotive maintenance products and services markets. As our

| ||

Charles M. Sonsteby Former Vice Chairman of The Michaels Companies

Director since:2016

Age:

Committees: •Audit(Chair) •Governance & Nominating •Compensation

| Professional Experience: Mr. Sonsteby has served as a

Education: Mr. Sonsteby holds a Bachelor of Science

Public Company Boards: Mr. Sonsteby

Non-Profit Boards: Mr. Sonsteby is a member of the University of Kentucky Gatton College of Business Dean’s Advisory |

Qualifications: As the former Vice Chairman and former Chief Financial Officer and Chief Administrative Officer of The Michaels Companies, Mr. Sonsteby’s experience and knowledge in the areas of retail operations, mergers and acquisitions, supply chain, international, finance, accounting, tax, treasury and investor relations provide him with the qualifications and skills to serve as a director on our Board. He also brings significant experience gained from service on the board of directors of Darden Restaurants.

| ||

|

Mary J. Twinem

Director since:2016

Age:

Committees: •Audit •Governance & Nominating •Compensation

| Professional Experience: Ms. Twinem has served as a

Education: Ms. Twinem holds a Bachelor of Science Public Company Boards: Ms. Twinem has served as a trustee of Investors Real Estate Trust (IRET), a real estate investment trust, since February 2018.

Privately-Held Company

Ms. Twinem Non-Profit Boards: Ms. Twinem has served as a director of Medica Holdings Company |

Qualifications: Ms. Twinem’s significant experience and knowledge in the areas of accounting, financial reporting, financial planning and analysis, mergers and acquisitions, investor relations and supply chain provide her with the qualifications and skills to serve as a director on our Board. She also brings significant franchise operations experience gained from her more than 20 years of service as an executive officer of Buffalo Wild

| ||||

The Board unanimously recommends that shareholders voteFOR the election of each director nominee.

|

✓

|

| 10 |   |

Proposal Two - Ratification of Independent Registered Public Accounting Firm

|

The Audit Committee of our Board of Directors (the “Audit Committee”) reviews our accounting firm’s qualifications, performance and independence in accordance with regulatory requirements and guidelines to determine whether to reappoint such firm as our independent registered public accounting firm. We refer to the fiscal years ending September 30, 2016, 20172018, 2019 and 20182020 as “fiscal 2016,2018,” “fiscal 2017”2019” and “fiscal 2018,2020,” respectively. Based on its review, the Audit Committee has recommended to the Board, and the Board has approved, the appointment of Ernst & Young LLP to audit Valvoline’s Consolidated Financial Statements and Internal Control Over Financial Reporting for fiscal 2018.2020. See the “Corporate Governance—Valvoline’s Board of Directors—Committees” section of this Proxy Statement for further information about the role and responsibilities of our Audit Committee.

The following table presents the aggregate fees (includingout-of-pocket costs) for professional services rendered by the member firms of Ernst & Young LLP and their respective affiliates (collectively, “EY”) for fiscal 2017. All audit fees incurred by Valvoline during2019 and fiscal 2016 were included in the consolidated financial statements of our former parent, Ashland Global Holdings Inc. (“Ashland”), as reflected in the Form10-K filed by Ashland for its fiscal year ended September 30, 2016.2018. The fees paid to EY shown in the table below were allpre-approved in accordance with Audit Committee procedures discussed in the “Audit Committee Matters” section of this Proxy Statement.

| 2017 | 2016 | |||||||

Audit Fees (1) | $ | 3,327,000 | $ | N/A | ||||

Audit-Related Fees (2) | $ | 17,000 | $ | N/A | ||||

Tax Fees (3) | $ | 113,000 | $ | N/A | ||||

All Other Fees (4) | $ | 0 | $ | N/A | ||||

Total | $ | 3,457,000 | $ | N/A | ||||

(in thousands) | 2019 | 2018 | ||||||

Audit Fees(1) | $ | 2,939 |

| $ | 3,037 |

| ||

Audit-Related Fees(2) | $ | 15 |

| $ | 30 |

| ||

Tax Fees(3) | $ | 74 |

| $ | 14 |

| ||

All Other Fees(4) | $ | 61 |

| $ | — |

| ||

Total | $ | 3,089 |

| $ | 3,081 |

| ||

| (1) | Audit fees include fees and expenses associated with the annual audit of Valvoline’s consolidated financial statements and internal controls over financial reporting and review of Valvoline’s interim consolidated financial statements. Audit fees also include fees associated with various audit requirements of Valvoline’s foreign subsidiaries (statutory audit requirements). |

| (2) | Audit-related fees |

| (3) | Tax fees |

| (4) | Other fees in fiscal 2019 relate to permitted risk management advisory services. |

Our shareholders are being asked to ratify the appointment of EY as Valvoline’s independent registered public accounting firm for fiscal 2018.2020. The appointment of EY will be deemed ratified if the number of votes cast “for” ratification exceed the number of votes cast “against” it. Abstentions and brokernon-votes will not be counted as votes cast “for” or “against” ratification. If our shareholders fail to ratify the appointment of EY, the Audit Committee may, but is not required to, reconsider the selection of such firm. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders.

The Company has been advised by EY that neither the firm, nor any covered person of the firm, has any financial interest, direct or indirect, in any capacity in Valvoline or its subsidiaries.

One or more representatives of EY will be present at the Annual Meeting to respond to questions from shareholders and will be given the opportunity to make a statement.

If no voting specification is made on a properly returned or voted proxy card, Samuel J. Mitchell, Jr. or Julie M. O’Daniel (as proxies named on the proxy card) will cast the votes represented by such proxy card FOR the ratification of EY as Valvoline’s independent registered public accounting firm for fiscal 2018.2020.

The Board unanimously recommends that shareholders voteFOR the ratification of | ||||

✓ | ||||

|

Proposal Three -Non-Binding Advisory Resolution Approving Executive Compensation

|

As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act, under Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are seeking your vote, on anon-binding advisory basis, on the compensation of our named executive officers as described in the Compensation Discussion and Analysis, compensation tables and narrative disclosure, as provided in this Proxy Statement. Specifically, shareholders are being asked to vote upon, and the Board has approved and unanimously recommends, the followingnon-binding advisory resolution:

RESOLVED, that the compensation paid to Valvoline’s named executive officers, as disclosed pursuant to Item 402 of RegulationS-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.

The Board believes that our executive compensation program is well-designed, appropriately aligns executive pay with companyCompany performance and incentivizes desirable executive performance. This proposal gives you an opportunity to express your own view of our 2017fiscal 2019 executive compensation practices. While the vote does not address any specific item of compensation and is not binding on the Board, the Board and its Compensation Committee (the “Compensation Committee”) value the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions.

The advisory resolution approving our executive compensation shall be deemed approved if the number of votes cast “for” the resolution exceed the number of votes cast “against” the resolution. Abstentions and brokernon-votes will not be counted as votes cast “for” or “against” the resolution.

If no voting specification is made on a properly returned or voted proxy card, Samuel J. Mitchell, Jr. or Julie M. O’Daniel (as proxies named on the proxy card) will cast the votes represented by such proxy card FOR the approval of the resolution.

The Board unanimously recommends that shareholders voteFOR the advisory resolution on our | ||||

✓ | ||||

| 12 |   |

|

We are seeking your vote to approve the Valvoline Inc. Employee Stock Purchase Plan (the “ESPP”). The ESPP was approved and adopted by our Board on November 14, 2017, subject to approval by the shareholders at the Annual Meeting, and will become effective upon receiving shareholder approval at the Annual Meeting.

The purpose of the ESPP is to provide eligible employees of the Company and certain of its subsidiaries an opportunity to use payroll deductions to purchase shares of our common stock and thereby acquire an ownership interest in the Company. The ESPP is intended to qualify as an “employee stock purchase plan” meeting the requirements of Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”).

The maximum aggregate number of shares of our common stock that may be purchased under the ESPP will be 2,000,000 shares, subject to adjustment as provided for in the ESPP. The share pool for the ESPP represents 1% of the total number of shares of our common stock outstanding as of December 4, 2017. In determining the number of shares to reserve for the ESPP, our Board of Directors considered the potential dilutive impact to shareholders, the projected participation rate over theten-year term of the ESPP, equity plan guidelines established by certain proxy advisory firms and advice provided by Deloitte, the compensation consultant to the Compensation Committee.

Summary of Material Terms of the ESPP

A summary of the material terms of the ESPP is set forth below. The summary is qualified in its entirety by reference to the full text of the ESPP, which is filed with this Proxy Statement as Appendix A.

Authorized Shares

Subject to adjustment as provided in the ESPP, a total of 2,000,000 shares of our common stock will be made available for sale under the ESPP. In the event of a stock dividend, stock split or combination of shares, recapitalization or other change in the Company’s capitalization, or other distribution with respect to our shareholders other than normal cash dividends, an automatic adjustment will be made in a manner that complies with Section 423 of the Code in the number and kind of shares as to which outstanding options then unexercised will be exercisable, in the available shares reserved for sale under the ESPP, and in the purchase period limit, in order to maintain the proportionate interest of the participants before and after the event.

As of December 4, 2017, the closing price of our common stock on the NYSE was $24.43 per share.

Plan Administration

Our Compensation Committee will administer the ESPP, and will have full and exclusive authority to interpret the terms of the ESPP and determine eligibility to participate, subject to the conditions of the ESPP.

Eligibility

Generally, employees of the Company and any of its designated subsidiaries are eligible to participate in the ESPP, subject to the procedural enrollment and other requirements in the ESPP. However, our Compensation Committee may, in its discretion, determine on a uniform basis prior to the beginning of an offering period that employees will not be eligible to participate if they: (i) have not completed at least two years of service since their last hire date (or such lesser period of time as may be determined by our Compensation Committee in its discretion), (ii) customarily work not more than twenty hours per week (or such lesser period of time as may be determined by our Compensation Committee in its discretion), (iii) customarily work not more than five months per calendar year (or such lesser period of time as may be determined by our Compensation Committee in its discretion), or (iv) are highly compensated employees within the meaning of Section 414(q) of the Code.

No employee may be granted options to purchase shares of our common stock under the ESPP if such employee (i) immediately after the grant would own capital stock possessing 5% or more of the total combined voting power or value of all classes of our capital stock, or (ii) holds rights to purchase shares of our common stock under all of our employee stock purchase plans (as defined in Section 423 of the Code) that accrue at a rate that exceeds $25,000 worth of shares of our common stock for each calendar year.

|

For purposes of the ESPP, designated subsidiaries include any subsidiary (within the meaning of Section 424(f) of the Code) of the Company that has been designated by our Compensation Committee as eligible to participate in the ESPP.

As of September 30, 2017, approximately 4,850 employees would be eligible to participate in the ESPP, including all of the Company’s executive officers.

Offering Periods

Pursuant to the terms of the ESPP, on the first trading day of an offering period, each eligible employee will be granted an option to purchase shares of our common stock on the last day of such offering period. Unless and until our Compensation Committee determines otherwise in its discretion, offering periods will be consecutive six month periods. If the ESPP is approved at the Annual Meeting, it is anticipated that the first offering period will commence during 2018.

Contributions

The ESPP permits each participant to purchase shares of our common stock through payroll deductions of up to 15% of his or her eligible compensation; provided, however, that a participant may not purchase more than 1,500 shares of our common stock during each offering period, subject to adjustment as provided in the ESPP. No interest will accrue on a participant’s contributions to the ESPP. A participant may decrease (but not increase) the rate of his or her contributions once per offering period. A participant’s payroll deduction authorization will remain in effect for subsequent offering periods unless the participant’s participation in the ESPP terminates or the participant withdraws from an offering period, as described below.

Purchases

Unless a participant terminates employment or withdraws from the ESPP or an offering period before the last trading day of an offering period, the participant’s option will automatically be exercised on the last trading day of each offering period. The number of shares of our common stock purchased will be determined by dividing the payroll contributions accumulated in the participant’s account by the applicable purchase price; provided, however, that a participant may not purchase more than 1,500 shares of our common stock during each offering period, subject to adjustment as provided in the ESPP. No fractional shares of our common stock will be purchased. Any contributions accumulated in a participant’s account which are not sufficient to purchase a full share of our common stock will be refunded to the participant, without interest.

Until otherwise determined by our Compensation Committee, the purchase price of the shares during each offering period will be 85% of the lower of (i) the fair market value per share of our common stock on the first trading day of each offering period or (ii) the fair market value per share of our common stock on the last trading day the offering period (which we refer to as the “purchase date”).

Withdrawals; Termination of Employment

A participant may end his or her participation at any time during an offering period and all, but not less than all, of his or her accrued contributions not yet used to purchase shares of our common stock will be returned to him or her, as soon as administratively practicable. If a participant withdraws from an offering period, he or she mustre-enroll in the ESPP in order tore-commence participation in a subsequent offering period.

If a participant ceases to be an eligible employee for any reason, he or she will be deemed to have elected to withdraw from the ESPP and his or her contributions not yet used to purchase shares of our common stock will be returned to him or her, as soon as administratively practicable.

Stockholders Rights

No participant will have any voting, dividend, or other stockholder rights with respect to shares of common stock subject to any option granted under the ESPP until such shares have been purchased and delivered to the Participant.

|

Holding Period

Unless otherwise determined by our Compensation Committee, participants in the ESPP will be required to hold the shares of our common stock acquired under the ESPP for theone-year period after the purchase date. During such holding period, a participant may not sell or transfer shares of common stock acquired under the ESPP.

Non-Transferability

A participant may not assign, transfer, pledge or otherwise dispose of in any way (other than by will or the laws of descent and distribution) his or her rights with regard to options granted under the ESPP or contributions credited to his or her account.

Corporate Transactions

The ESPP provides that in the event of a reorganization, merger, or consolidation of the Company with one or more corporations in which the Company is not the surviving corporation (or survives as a direct or indirect subsidiary of such other constituent corporation or its parent), or upon a sale of substantially all of the property or stock of the Company to another corporation, a successor corporation may assume or substitute each outstanding option. If the successor corporation refuses to assume or substitute for the outstanding option, the offering period then in progress will be shortened, and a new purchase date will be set. The Company will notify each participant that the purchase date has been changed and that the participant’s option will be exercised automatically on the new purchase date unless prior to such date the participant has withdrawn from the offering period.

Amendment; Termination

Our Compensation Committee, in its sole discretion, may amend, suspend, or terminate the ESPP at any time and for any reason. If the ESPP is terminated, our Compensation Committee, in its discretion, may elect to terminate the outstanding offering period either immediately or upon completion of the purchase of shares of our common stock on the next purchase date (which may be sooner than originally scheduled, if determined by our Compensation Committee in its discretion), or may elect to permit the offering period to expire in accordance with its terms. If the offering period is terminated prior to expiration, all amounts then credited to participants’ accounts that have not been used to purchase shares of our common stock will be returned to the participants as soon as administratively practicable.

Our Compensation Committee may change the offering periods, designate separate offerings, limit the frequency and/or number of changes in the amount withheld during an offering period, permit contributions in excess of the amount designated by a participant in order to adjust for delays or mistakes in the Company’s processing of properly completed contribution elections, establish reasonable waiting and adjustment periods and/or accounting and crediting procedures to ensure that amounts applied toward the purchase of our common stock for each participant properly correspond with contribution amounts, and establish such other limitations or procedures as our Compensation Committee determines in its sole discretion advisable that are consistent with the ESPP. Such modifications will not require shareholder approval or the consent of any ESPP participants.

In addition, if our Compensation Committee determines that the ongoing operation of the ESPP may result in unfavorable financial accounting consequences, our Compensation Committee may, in its discretion and, to the extent necessary or desirable, modify, amend or terminate the ESPP to reduce or eliminate such accounting consequence. Such modifications or amendments will not require shareholder approval or the consent of any ESPP participants.

The ESPP automatically terminates on January 31, 2028, unless terminated earlier by the Compensation Committee.

Sub-Plans

Consistent with the requirements of Section 423 of the Code, our Compensation Committee may amend the terms of the ESPP, or an offering, or provide for separate offerings under the ESPP to, among other things, reflect the impact of local law outside of the United States as applied to one or more eligible employees of a designated subsidiary and may, where appropriate, establish one or moresub-plans to reflect such amended provisions.

|

Certain Federal Income Tax Effects

The following summary briefly describes U.S. federal income tax consequences of options granted under the ESPP, but is not a detailed or complete description of all U.S. federal tax laws or regulations that may apply, and does not address any local, state or other country laws. Therefore, no one should rely on this summary for individual tax compliance, planning or decisions. Participants in the ESPP should consult their own professional tax advisors concerning tax aspects of options granted under the ESPP. The discussion below concerning tax deductions that may become available to the Company under U.S. federal tax law is not intended to imply that the Company will necessarily obtain a tax benefit from those deductions. Taxation of equity-based payments in other countries is complex, does not generally correspond to U.S. federal tax laws, and is not covered by the summary below.

The ESPP is intended to qualify as an “employee stock purchase plan” meeting the requirements of Section 423 of the Code. Under these provisions, a participant will not recognize taxable income until he or she sells or otherwise disposes of the shares purchased under the ESPP. If a participant disposes of the shares acquired under the ESPP more than two years from the option grant date (i.e., the first day of the offering period) and more than one year from the date the stock is purchased, then the participant must treat as ordinary income the amount by which the lesser of (i) the fair market value of the shares at the time of disposition, or (ii) the fair market value of the shares at the option grant date, exceeds the purchase price. Any gain in addition to this amount will be treated as a capital gain. If a participant holds shares at the time of his or her death, the holding period requirements are automatically deemed to have been satisfied and he or she will realize ordinary income in the amount by which the lesser of (i) the fair market value of the shares at the time of death, or (ii) the fair market value of the shares at the option grant date, exceeds the purchase price. The Company will not be allowed a deduction if the holding period requirements are satisfied.

If a participant disposes of shares before expiration of two years from the date of grant and one year from the date the stock is purchased, then the participant is deemed to have a disqualifying disposition and must treat as ordinary income the excess of the fair market value of the shares on the purchase date over the purchase price. Any additional gain or loss will be treated as long-term or short-term capital gain or loss, depending on the participant’s holding period with respect to such shares. The Company will be allowed a deduction equal to the amount of ordinary income recognized by the participant in a disqualifying disposition.

New Plan Benefits

As of the date of this Proxy Statement, no employee has been granted any options under the proposed ESPP. Accordingly, the benefits to be received pursuant to the ESPP by the Company’s executive officers and employees are not determinable at this time.

If no voting specification is made on a properly returned or voted proxy card, Samuel J. Mitchell, Jr. or Julie M. O’Daniel (as proxies named on the proxy card) will cast the votes represented by such proxy card FOR the approval of the Valvoline Inc. Employee Stock Purchase Plan.

| ||||

| ||||

|

|

Valvoline’s Board of Directors

Our business and affairs are managed under the direction of our Board. Our Corporate Governance Guidelines require thattwo-thirds of our directors be independent, as defined in our Director Independence Standards (published on our investor relations website athttp://investors.valvoline.com/governance) (“Independence Standards”), which incorporate the requirements of SEC rules and NYSE listing standards. Within this framework, the G&N Committee is charged with determining and refreshing, as appropriate, the composition of our Board. The G&N Committee seeks to fill our Board with exceptionally talented and diverse directors, with expertise and leadership experience in the markets in which we operate.

Our Board currently consists of the following eight members, all of whom were elected at the 2017 Annual Meeting of Shareholders:nine members: Gerald W. Evans, Jr., Richard J. Freeland, Stephen F. Kirk, Carol H. Kruse, Stephen E. Macadam, Vada O. Manager, Samuel J. Mitchell, Jr., Charles M. Sonsteby, and Mary J. TwinemTwinem. All of the directors, other than Mr. Evans, were elected at the 2019 Annual Meeting of Shareholders. At its meeting on November 14, 2019, the Board increased its size from eight to nine members and William A. Wulfsohn. At the end of fiscal 2017,elected Mr. Wulfsohn resignedEvans, effective December 1, 2019, to serve as Chairmana member of the Board and notifiedwith a term expiring at the Board that he would not stand forre-election upon the expiration of his term as a Director at the2020 Annual Meeting. Each of the other sevencurrent directors on the Board has been nominated forre-election at the 2020 Annual Meeting. The Board expresses its gratitude to Mr. Wulfsohn for his dedicated service and counsel to the Company as it transitioned from a long-time business unit of Ashland to an independent, publicly traded company. The Board has resolved to reduce its size from eight to seven members effective as of the date of the Annual Meeting to eliminate the vacancy that would otherwise result from Mr. Wulfsohn’s decision not to stand forre-election. See the “Proposal One—Election of Directors” section of this Proxy Statement.

During fiscal 2017, nine2019, seven meetings of the Board were held. Each director attended at least 75% of the total meetings of the Board and the Committee(s) on which he or she served. Overall attendance at Board and Committee meetings was 100%.

Our Amended and RestatedBy-Laws (“By-Laws”) provide the Board flexibility in determining the appropriate leadership structure for the Company. Currently, Mr. Mitchell serves as our Chief Executive Officer and Mr. Kirk serves as Chairman of the Board. The Board (Mr. Wulfsohn served in that role from the date of our IPO through fiscal 2017). With the Company’s recent IPO and separation from Ashland, the Boardcurrently believes that separating the roles of Chairman and Chief Executive Officer is in the best interest of the Company because it allows Mr. Mitchell to guide our newly public company and focus on operating and managing theday-to-day activities of our business, while Mr. Kirk can focus on Board leadership independent of management.

The Board will periodically review and reassess our Board leadership structure and determine whether it is in the Company’s and our shareholders’ best interest to continue the separate roles of Chairman and Chief Executive Officer. In the event that the Board combines the role of Chairman and Chief Executive Officer, our Corporate Governance Guidelines require the Board to appoint a lead independent director.

Our Corporate Governance Guidelines require thattwo-thirds of our directors be independent, as defined in the Independence Standards. The Independence Standards incorporate the requirements of SEC rules and NYSE listing standards, and were adopted by our Board to assist in its determination of director independence. Pursuant to these rules, our Board must make an affirmative determination that those members of the Board who serve as independent directors have no material relationship with our companythe Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company)Company). Members of the Audit and Compensation Committees are also subject to heightened standards for independence under SEC rules and NYSE listing standards.

Our Board annually reviews director independence in accordance with these requirements. In making its independence determinations, the Board considered relationships and transactions between each director, on the one hand, and Valvoline, its subsidiaries and its affiliates, on the other hand, including the director’s commercial, economic, charitable and familial relationships. As a result of this review, the Board affirmatively determined that

|

Ms. Kruse, Ms. Twinem and Messrs. Evans, Freeland, Kirk, Macadam, Manager and Sonsteby and Ms. Twinem are each independent of Valvoline and its affiliates. Mr. Mitchell was determined not to be independent because he currently serves as Chief Executive Officer of the Company, and Mr. Wulfsohn was determined not to be independent because he serves as Chief Executive Officer of Ashland, Valvoline’s controlling shareholder through May 12, 2017.

In determining the independence of Mr. Freeland, our Board considered transactions entered into in the ordinary course of business with Cummins Inc., a company in which Mr. Freeland serves as an executive officer. In Cummins’ last fiscal year, Valvoline paid $1.64 million to Cummins and Valvoline received $36.59 million from Cummins, representing 0.01% and 0.2%, respectively, of Cummins’ consolidated gross revenues of $17.5 billion for such fiscal year. Similarly, the amount the Company paid to Cummins and the amount received by the Company from Cummins in each of the two preceding fiscal years did not exceed the greater of $1 million or 2% of Cummins’ consolidated gross revenues in such fiscal years. All transactions with Cummins were made at arms-length, included standard commercial terms, and Mr. Freeland did not personally benefit from any of such transactions. The Board concluded that Mr. Freeland was independent, because the transactions were not material to Cummins such that Mr. Freeland could be unduly influenced by, and thus not independent of, Valvoline management. The G&N Committee determined that the transactions with Cummins were not “Related Person Transactions” as defined in the Company’s Related Person Transaction Policy.Company.

In addition, the Board determined that Ms. Twinem and Messrs. Manager and Sonsteby and Ms. Twinem each satisfy the heightened independence standards applicable to audit committee members, including those under Exchange Act Rule10A-3. Similarly, the Board determined that Ms. Kruse, Ms. Twinem and Messrs. Evans, Freeland, Kirk, Macadam, Manager

| PROXY STATEMENT 13 |

and Sonsteby and Ms. Twinem each satisfy the heightened independence standards applicable to compensation committee members as set forth in NYSE listing standards.

Our Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee and a G&NGovernance & Nominating Committee (each a “Committee” and, collectively, the “Committees”) to assist in the performance of the Board’s various functions. All committeeCommittee members are appointed by our Board upon recommendation of the G&N Committee.

Listed below are the members of each of the three standing committees.Committees. As discussed above in “—Independence,” our Board has determined that all of the members of these Committees are independent as defined by our Independence Standards, including, in the case of Audit and Compensation Committee members, the heightened standards for independence under SEC rules and NYSE listing standards.

Audit Committee | ||||||

Vada O. Manager | Charles M. Sonsteby* | Mary J. Twinem | ||||

Compensation Committee(1)(2) | ||||||

Gerald W. Evans, Jr. | Richard J. Freeland | Stephen F. Kirk | ||||

Carol H. Kruse | Stephen E. Macadam | Vada O. Manager | ||||

Charles M. Sonsteby | Mary J. Twinem* | |||||

Governance and Nominating Committee(1)(2) | ||||||

Gerald W. Evans, Jr. | Richard J. Freeland | Stephen F. Kirk | ||||

Carol H. Kruse | Stephen E. Macadam | |||||

Vada O. Manager* | ||||||

Charles M. Sonsteby | Mary J. Twinem | |||||

| * | Chair |

| (1) | Effective December 4, 2018, Ms. |

| (2) | Effective December 1, 2019, Mr. |

The responsibilities of each of our Committees are described below. Each of the Committees operates under a written charter; must meet at least four times a year, plus additional meetings as circumstances require; has authority to retain independent legal, accounting or other advisors; makes regular reports to the Board; and reviews its own performance annually. TheEach Committee’s charter of each Committee is available on our investor relations website athttp://investors.valvoline.com/governance.

|

Audit Committee |

Number of Meetings in Fiscal |

The Board has established the Audit Committee in accordance with Section 3(a)(58) of the Exchange Act. The Audit Committee is currently composed of three members and the Board has determined that each member of the Audit Committee is “independent” and “financially literate,” as such terms are defined by NYSE listing standards. In addition, the Board has determined that each member of the Audit Committee is an “audit committee financial expert” as that term is defined by SEC rules. A director may not serve on the Audit Committee if he or she serves on the audit committee of more than two other public companies, unless the Board determines that such simultaneous service and time commitment would not impair the director’s ability to effectively serve on the Audit Committee.

The Audit Committee is responsible for, among other things, assisting the Board in fulfilling its oversight responsibilities with respect to:

overseeing the integrity of our financial reporting process, including earnings releases and the filing of financial reports;

| 14 |  | PROXY STATEMENT |

reviewing the quality and adequacy of accounting and financial controls;

selecting and evaluating the performance of our internal auditors, who report directly to the Audit Committee;

approving fees and services of our independent registered public accounting firm;

overseeing our internal audit function, including the head of internal audit;

reviewing the effectiveness of our legal and regulatory compliance programs;

reviewing, at least annually, our enterprise risk assessment and management policies, including the Company’s major enterprise and financial risk exposures and steps taken by management to monitor and mitigate such risks;

evaluating significant financial matters and decisions, such as capital structure, dividend policy, offerings of corporate securities, major borrowings, credit facilities, derivatives and swaps policies (including entry into swaps in reliance on

overseeing funding and investment policy related to employee benefit plans.plans;

reviewing and investigating any matters pertaining to the integrity of executive management, and overseeing compliance by management with laws, regulations and our Global Standards of Business Conduct;

reviewing, at least annually, the Company’s policies, programsinsurance program, including casualty, property, cyber and practices with respect to environmental, healthdirectors’ and safety risks;officers’ liability insurance;

reviewing, at least annually, the Company’s cyber security risks and programs established to manage such risks; and

establishing and maintaining procedures for handling complaints regarding accounting, internal auditing controls and auditing matters, including procedures for confidential, anonymous submission of such complaints.

Compensation Committee |

Number of Meetings in Fiscal |

The Compensation Committee is currently composed of sixeight members and the Board has determined that each member of the Compensation Committee is “independent” as such term is defined by NYSE listing standards and SEC rules and qualifies as a“non-employee director” pursuant to Rule16b-3 under the Exchange Act and as an “outside director” pursuant to Section 162(m) of the Code.Act.

The Compensation Committee is responsible for, among other things:

overseeing the implementation and administration of the Company’s compensation plans;

adopting, amending, terminating and otherwise designing employee benefits plans;

ensuring that Valvoline’s executive compensation programs are appropriately competitive, support organizational objectives and shareholder interests and emphasize pay for performance linkage;

|

reviewing compensation policies and practices for all employees, and assessing risks associated with such policies and practices;

approving any employment agreements, consulting arrangements, severance or retirement arrangements,change-in-control change in control agreements and/or special or supplemental benefits covering any current or former executive officer;

overseeing the execution of CEO and senior management development and succession plans;

reviewing and approving any perquisites provided to executive officers;

reviewing and recommending to the Board of Directors’ the form and amount of director compensation;

overseeing regulatory compliance on compensation matters, including the Company’s policies on structuring compensation programs to preserve tax deductibility;

| PROXY STATEMENT 15 |

reviewing and approving the preparation of the annual report on executive compensation;“Compensation Discussion and Analysis” section and “Compensation Committee Report” included in this Proxy Statement;

overseeing compliance with NYSE requirements relating to shareholder approval of equity compensation plans; and

determining the independence and compensation of, and overseeing the work completed by, any compensation consultant, independent legal counsel or other advisor that it retains.

Governance and Nominating Committee |

Number of Meetings in Fiscal |

The G&N Committee is currently composed of sixeight members and the Board has determined that each member is “independent” as such term is defined by NYSE listing standards. The G&N Committee is responsible for, among other things:

identifying qualified nominees (i) for shareholder election and (ii) for election by the Board to fill any vacancies that occur between annual meetings of shareholders, in each case, consistent with criteria approved by the Board relating to personal and professional integrity, ability, judgment, expertise, experience and diversity;

reviewing potential director candidates and nominations forre-election and reporting the results of such reviews to the Board;

identifying board members qualified to fill any vacancies on a committee of the Board;

reviewing appropriateness of directors’ continued service on the Board or the committees of the Board;

reviewing transactions pursuant to the Company’s Related Person Transaction Policy set forth in the Company’s Corporate Governance Guidelines;

recommending stock ownership guidelines for employees andnon-employee directors and programs and procedures relating to director evaluation, retention and retirement;

defining and reviewing the responsibilities of the Board with respect to the Company’s corporate governance, including review of proposed amendments to the Company’s articles orArticles,by-lawsBy-laws and Corporate Governance Guidelines of the Company and the conduct of the meetings of the Board, the committees of the Board and the Company’s shareholders;

reviewing and recommending policies and procedures to ensure the Board and its committees are properly constituted and organized;

reviewing all Board committee charters;

reviewing and, if necessary, making recommendations as to shareholder proposals; and

reviewing the succession process for senior management.

|

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee (Ms. Kruse, Ms. Twinem and Messrs. Evans, Freeland, Kirk, Macadam, Manager and Sonsteby) (i) was an officer or employee of Valvoline at any time during or prior to fiscal 20172019 or (ii) is or was a participant in a “related person” transaction with Valvoline since the beginning of fiscal 2017.2019. No executive officer of the Company served on the compensation committee or board of any company that employed any member of Valvoline’s Compensation Committee or Board of Directors.

Chairman of the Board. During fiscal 2017, Mr. Wulfsohn served as ourNon-Executive Chairman of the Board. In connection with Mr. Wulfsohn’s resignation as Chairman, Mr. Kirk was unanimously appointed by the Board to serve as ourNon-Executive Chairman, effective October 1, 2017.2017 and was reappointed to that role on January 30, 2019. The Chairman of the Board organizes Board activities to effectively provide guidance to, and oversight and accountability of,

| 16 |  | PROXY STATEMENT |

management. To fulfill that role, the Chairman of the Board, among other things, creates and maintains an effective working relationship with the Chief Executive Officer and the other members of senior management and the Board, assures that the Board agenda is appropriately directed to the matters of greatest importance to the Company and provides senior management with the Board’s advice, direction and opinions. TheNon-Executive Chairman preserves the distinction between management and oversight, maintaining the responsibility of management to develop corporate strategy and the responsibility of the Board to review and express its views on corporate strategy.

Board and Committee Meetings. The Board and Committees must hold regularly scheduled meetings. Directors are expected to attend all meetings of the Board and of the Committees on which they serve.Non-management directors meet in executive session at each regularly scheduled meeting of the Board, and at other times as they may determine appropriate.

Evaluation of Board Effectiveness. The Board must conduct annual self-evaluations to determine whether it and its Committees are functioning effectively. The G&N Committee receives comments from all directors and reports to the Board with an annual assessment of the Board’s performance, with a focus on the Board’s contribution to the Company and areas in which the Board or its Committees can improve. We may also engage independent, third-party governance experts from time to time to conduct interviews and/or assessments regarding the structure and effectiveness of our Board and its committees. The Committees of our Board of Directors have all adopted charters defining their respective purposes and responsibilities. Pursuant to these charters, the Committees must review their respective performances at least annually and each of the Committees has authority to engage independent legal, accounting or other advisors.

The Board’s Role in Risk Oversight

The Board has an active role, as a whole, and also at the committee level, in overseeing management of the Company’s risk. The Board approves and monitors the fundamental financial and business strategies of the Company and maintains policies and procedures designed to ensure that the assets of the Company are properly safeguarded and enterprise risks are properly managed, that appropriate financial and other controls are maintained, that processes are in place for maintaining the integrity of the Company and that the Company’s business is conducted in compliance with applicable laws and regulations. Management is responsible for theday-to-day management of risk, and members of our senior management regularly report to the Board and its Committees on current and emerging risks and the Company’s approach to avoiding and mitigating risk exposure. The Board reviews in detail the Company’s most significant risks and whether management is responding consistently within the Company’s overall risk management and mitigation strategy. While the Board is ultimately responsible for overall risk oversight at our Company, the Committees assist the Board in fulfilling its oversight responsibilities in certain areas. In particular, the Audit Committee has primary responsibility for monitoring the Company’s major financial risk exposures and the steps the Company has taken to control such exposures, including the Company’s risk management policies and processes. ThePrior to September 2019, the Audit Committee also assistsassisted the Board in fulfilling its oversight responsibility with respect to environmental, health and safety (“EH&S”) risks and programs. Given the importance of EH&S matters, the Board amended the Audit Committee charter to move this oversight function to the full Board. EH&S risks and programs are now reviewed by the Board at least twice per year. The Compensation Committee monitors the risks associated with our compensation policies and procedures. The G&N Committee is charged with reviewing and recommending governance policies and procedures, including Board and Committee structure,

|

leadership and membership, that ensure independence of the Board as it exercises its corporate governance and risk oversight roles. The G&N Committee also reviews transactions pursuant to our Related Person Transaction Policy (which is further described in “—Other Governance Policies and Practices—Related Person Transaction Policy”).

Other Governance Policies and Practices

Overview of Governance Principles